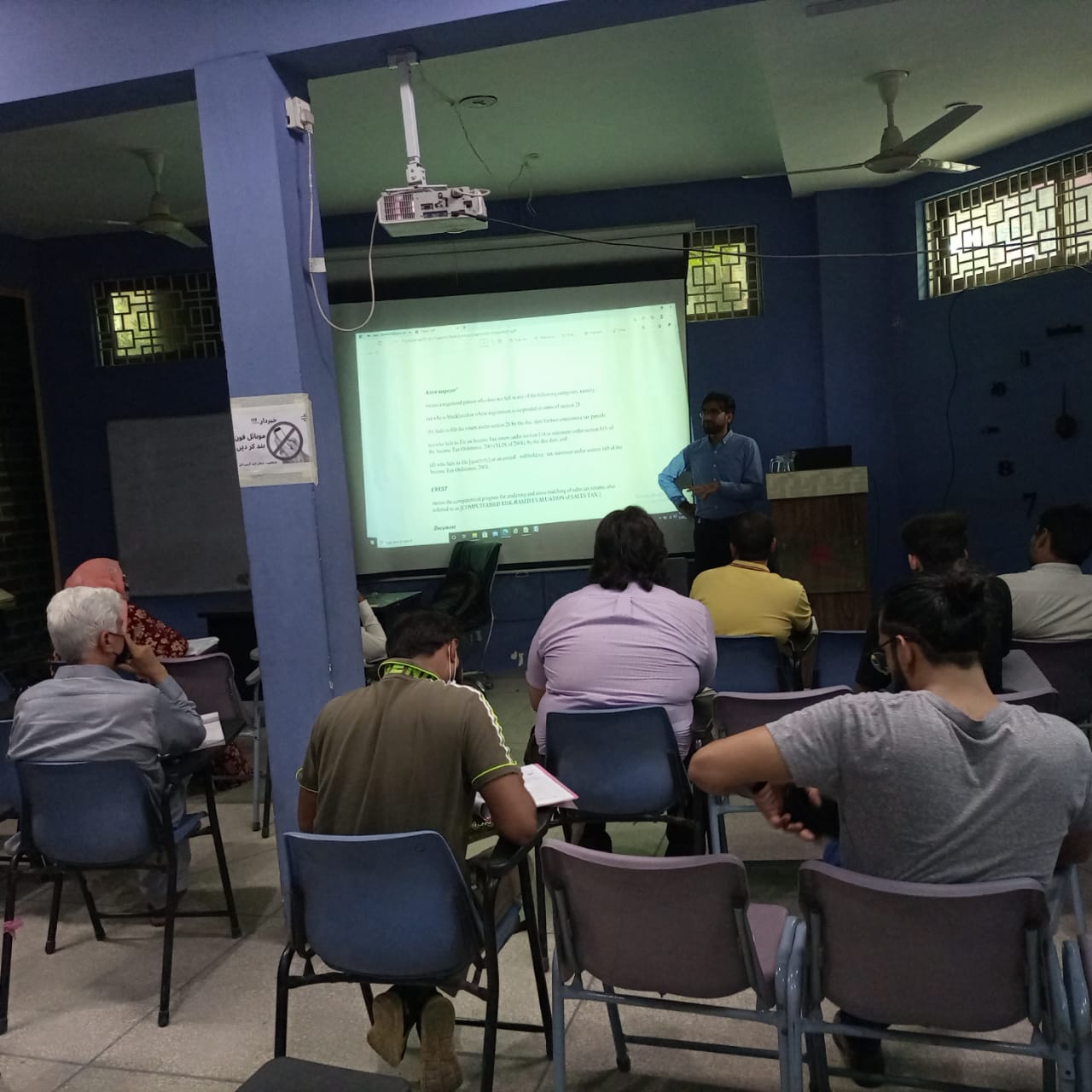

Our tax training courses are also aimed at individuals working at or with associations. ITT would be providing them with tax guidance and relevant skills which would come in useful for both personal tax assessment and commercial practices. ITT has its own criteria for membership of our private association i.e ACTP ( Association of certified tax practitioners) where we have members from different educational and professional backgrounds. Membership exchange programs can be fruitful for harmony among different associations with somehow similar objectives.

ACTP is our private association of over 500 members of various professional backgrounds and practical experience of multiple sectors. We provide tax advices/solutions and support to our association member’s .Our support team is available 24/7 to answer the queries of our members. We also encourage true and fair view of financial position and performance of an individual, AOP or corporate to be reflected and declared. For this purpose we aim to join associations, so that all the members of the association will be able to have tax assistance for themselves, under the supervision of tax experts of one of our associates firms mastermindz audit accounts and taxation with proper understanding of tax situations.

Our tax training courses are also aimed at individuals working at or with associations. ITT would be providing them with tax guidance and relevant skills which would come in useful for both personal tax assessment and commercial practices. ITT has its own criteria for membership of our private association i.e ACTP ( Association of certified tax practitioners) where we have members from different educational and professional backgrounds. Membership exchange programs can be fruitful for harmony among different associations with somehow similar objectives.

ACTP is our private association of over 500 members of various professional backgrounds and practical experience of multiple sectors. We provide tax advices/solutions and support to our association member’s .Our support team is available 24/7 to answer the queries of our members. We also encourage true and fair view of financial position and performance of an individual, AOP or corporate to be reflected and declared. For this purpose we aim to join associations, so that all the members of the association will be able to have tax assistance for themselves, under the supervision of tax experts of one of our associates firms mastermindz audit accounts and taxation with proper understanding of tax situations.

ACTP is our private association of over 500 members of various professional backgrounds and practical experience of multiple sectors. We provide tax advices/solutions and support to our association member’s .Our support team is available 24/7 to answer the queries of our members. We also encourage true and fair view of financial position and performance of an individual, AOP or corporate to be reflected and declared. For this purpose we aim to join associations, so that all the members of the association will be able to have tax assistance for themselves, under the supervision of tax experts of one of our associates firms mastermindz audit accounts and taxation with proper understanding of tax situations.

Our tax training courses are also aimed at individuals working at or with associations. ITT would be providing them with tax guidance and relevant skills which would come in useful for both personal tax assessment and commercial practices. ITT has its own criteria for membership of our private association i.e ACTP ( Association of certified tax practitioners) where we have members from different educational and professional backgrounds. Membership exchange programs can be fruitful for harmony among different associations with somehow similar objectives.